Import to China: how to enter e-commerce, cross border and offline markets

“How can I import to China and start selling my products there?” is the question every entrepreneur and business owner asks lately. China’s market size make it seem appealing to companies trying to expand internationally, it also relates closely to China’s growing middle class, which by the year 2022 will have same spending power as the middle class of Italy (earning $9,000 to $34,000 a year) but with a population of 550 million people.

“How can I import my products and sell them in China?” is the question every entrepreneur and business owner asks lately. China’s market size make it seem appealing to companies trying to expand internationally, it also relates closely to China’s growing middle class, which by the year 2022 will have same spending power as the middle class of Italy (earning $9,000 to $34,000 a year) but with a population of 550 million people.

To gain a better understanding of the topic “import to China”, we discussed with ASI Group, a service provider which helps hundreds of brands entering the Chinese market, by providing supply chain, logistics ,and import solutions.

1-Could you briefly describe what is your company about? And what are its main activities?

ASI Group is a business facilitator company based in Shanghai since 2008, we are specialized in helping companies wanting to import from Europe and export from Asia, mainly China, Vietnam, Cambodia and whether you want to penetrate Chinese market or export manufactured products across the world. Our services includes: Global Trade Management, integrated supply chain solutions: E-commerce, textile and Food & Beverage solutions.

-

Expansion in China

2-If a company is wishing to expand and start selling in China, does it need to be physically present in the country?

Strictly speaking, yes. Normally, a company should have an entity in China to be able to invoice Chinese customers.

Except if it grows through distributers and resellers, who will buy products from the country of origin. But in this case, the brand might have little to no information of who exactly sells the products in China or how they are sold.

This is the case for some brands who are used to working with distributors and promoters.

If a company wants to have control of their distribution in China, they must be able to invoice using an established Chinese entity.

One way to find a compromise is to use existing structures of importers or agents.

Some companies go further and take care of the whole supply chain, physical flow, documentation, and payments, like ASI.

Regarding a cross border operation, companies are required to have a Chinese legal partner who will represent them on cross border platforms. In that case your Chinese partner will be responsible for the product that you are selling.

Want to localise your marketing materials for the Chinese market? Need help communicating on an upcoming trade show? Shoot us a line!

3-What are the fastest ways to enter the Chinese market when considering the legal side, such as incorporation and bank/tax account setting up?

While the brand is going through the registration of a new company, which takes around 8 months, they can use agents like ourselves to handle all their paperwork, invoicing, as well as reporting.

This is the fastest way to start the operation. This is also a good way to test the market for the first few shipments, without the risk of investing in the legal side and loosing time setting up a company, when in the end the success is not guaranteed.

4-How can foreign brands begin to start selling their products in China? What are the different ways?

Brands can sell their products through mass offline retail, wholesale, F&B channel (hotels, restaurants, bars), e-commerce, TV Shopping, App shopping, and more. China has developed dozens of business channels with the aim of increasing spending.

You have all the distributers, who could also be an intermediary and who could sell later on and they can be situated between manufacturer and mass retail. And of course, with mass retail, you have to distinguish for sure between offline and online. The online market is growing fast in China and is overtaking traditional offline retailers as well. Online selling has a strong potential, which can be better developed here than in Europe or the US.

5-Should a brand concentrate on online or offline markets when doing business in China?

When you start to import to China, you will have many retail options. Right now online shopping is a big trend in China. But the choice between online and offline models depends on the category of the product.

For apparel products for example, experimenting on different online platforms is a must as the market needs more distribution levels, even though the brands still have a lot of offline presence. Think of Uniqlo, Adidas, and others. Online represents 10-30% of their overall business.

But it’s very hard to say because it depends whether your initial business model strategy is more focused on online or offline. I know some Chinese brands of textiles who are 100% online. They have no physical presence.

If you push your online channels you still should have some offline outlets, especially if you are not a known brand. One needs to create visibility and credibility.

Chinese consumer, before buying any product, will always check online what it is said about the brand and its products on the different social media.

Your offline operation could be a window of marketing that shows your products and convinces people to buy online. In fact, many physical stores are playing the role of a showroom mixed with an “entertainment spot”. Indeed, the Chinese consumer, before buying any product, will always check online what it is said about the brand and its products on the different social media. If the brand has no online presence, no one is mentioning it, then it will be very difficult to attract sales. That is why it is crucial to work on brand awareness in china’s online ecosystem, before even importing.

6-From your experience, what are the biggest challenges brands are facing when starting to import to China?

I would say a lot of brands come with a product that they want to sell to Chinese customers. However, sometimes it’s better to go the other way around and ask, “What do the Chinese customers want?”

Most brands don’t know the Chinese customer preferences or habits. They say, “I have a good product that works worldwide in 10 different countries, for sure it’s going to work in China”. This is not the case.

Maybe 10 or 15 years ago most foreign products would import to China almost anything and it could work, but now the competition is so high, you have to show the Chinese customers that your products offer added value to their life.

This can be done by learning about your target customer and personalizing your marketing strategy according to your target, long before importing and selling your goods.

For example, you know that Chinese people don’t like overly sweet tastes. So, if you are a pastry manufacturer, maybe you may have to lower the amount of sugar in your products.

Packaging is another thing when you want to import to China. Maybe in Europe people like to have “family packs”, but in China they will go for different sizes. For example, milk. In Europe the best sales are 1 Liter pack, in China it is the 500 ml.

When we say “adaptability” it doesn’t always mean recipes. It might be naming, packaging, delivery time, brand story and so on.

Some brands, who sell to China don’t have any knowledge about their products in China. Due to the sales rights, which brands give to the importers or general distributors, in the end brands don’t have any insights of what Chinese customers actually need.

The only knowledge they have comes from their distributors and those may pay attention only to the most obvious facts that are not necessarily the essential ones.

Wherever you want to sell your products, you have to know your customers. This comes of course firstly with the research, but also with experience. And this is the information brands lack when they export the products without being here. Brands in the end may not have the opportunity to redesign or change the recipe of their products to better fit to the Chinese market, and will then inevitably fail.

-

Import process:

7- Import to China: will all products make the cut?

When talking about imports, one must remember, all countries have their regulations. One product might be blacklisted not because it is harmful, but because of one of the ingredients.

For example, if you want to import lasagna, Chinese authorities will check that the meat in the product comes from a licensed and approved by Chinese authorities producer.

So your vegetable lasagna might have a green light, but you must change your producer of the meat for lasagna. This means, before you even start calculating costs of your import to China, you will need to adjust your production to fit the Chinese market. In this case you should always check the ingredients.

Once you are sure that your category of products is importable, you have to provide information about the product itself including the ingredients that you put in your products, even small percentages, all the conservatives, all the colorants, etc. And you have to check one by one and make sure that all those ingredients are allowed in China.

Then you have to look at the financial side. Maybe the taxes for this category of products will be 100%, which might make the product non-competitive. If competition here is selling at one yuan and I sell at 10 yuan after taxes, maybe there is no point importing it.

Here is where your decision might depend on the marketing survey we talked about earlier, which will help you to understand how to position your product, will you want to sell in premium or even luxury category etc.

When your decision is made, the actions are to come.

Let’s say a brand owner decided “ I want to start with one container”, what shall he start with?

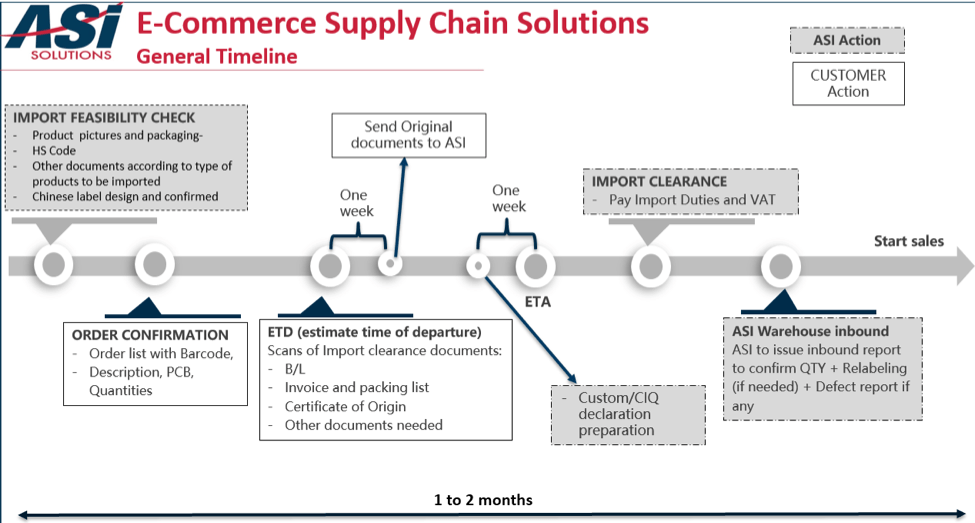

Here are some important steps in your everyday import business that is accurate for China with some time frame:

- The market research takes 3 to 8 months,

- The importability check takes 2-4 weeks depending on the ingredients.

- The production of let’s say one container takes about 3 weeks ( depending on the production lead time of the product )

- The export 1 week.

- The shipping with logistics from Europe (France) to China, by sea it takes about 1 month.

- Then there is import clearance and re-labelling (according to the law, all products that sell in China must have a Chinese label on them). This could take up to 2 weeks to have clearance and labelling done here.

- Then the CIQ test (on food products) takes 21 days, but it starts at the same time as the import and custom clearance.

Then the shipment goes to the warehouse. The products are labelled and ready to be sold. So are you are all set in about 2 months!

This works for dried food and for frozen products etc. but if you work with fresh food it is obviously going to be more complicated.

Regarding the budget, with around EUR 10,000 you can import to China a container, have it cleared, and it will take 2 months. Market research can cost more than EUR 5000.

Another thing to keep in mind, most offline and more and more online retailers in China refuse to accept your products if they have passed 1/2 or sometimes even 1/3 of the expiration time. So, if your products have 12 months of expiration time, you must sell them all within 6 months.

If your products have passed even one day over their limit, you can only sell them at a discount. That’s one of the drawbacks for new brands who import to China a few containers of food as a “trial” batch.

8-Do you think second and third tier cities still appreciate and look for imported products?

Yes. There is actually a huge boom. In second and third tier cities, people have fewer choices. In Shanghai and Beijing you can find everything you want. In terms of income, there is not much difference as the middle class of China exists throughout China. Wealthy people are not living solely in the top 3 cities, and they want to buy imported goods just as much.

Furthermore, in those areas in China there is still less competition. That’s why e-commerce is working better in those cities. So when you want to test the water, consider to import to China starting with those cities.

Depending on the target of the brand, some brands prefer to begin in lower tier. They start getting known in these second and third tier cities and do good business there because there is less competition, then head to the big cities. It’s a good test, because it’s also cheaper to be there.

For example some supermarkets, started online almost 2 years ago, and now they open their first offline shop this week in Shanghai.

Same for some fashion brands, they start online and then switch to offline. So, online can be the first trial of a market and can be adapted according to the development of the brand and its strategy.

To have a better understanding of the market and prepare for analytical work, we recommend conducting a real market study with a professional marketing agency. Things like market surveys, focus group tests, etc. are very important when entering such a big and segmented market like China.

Brands must find information about the distribution channels, product categories and large marketplaces like JD and so on. They need the information in order to see when the biggest periods of sales are. Whether to sell more in May than in December, for example. They also need to understand what the demographics of their customers are.

One of the advantages of the e-commerce business is that brands have access to analytics from the marketplace.

After you go and start building a business offline, for sure you also need to have some insights as we mentioned earlier such as focus groups, etc.

So, we advise the brands to have this study done before they start to sell.

-

Cross border E-commerce in China

9-How big is a cross border model of business today in China?

Cross border is 10% of the penetration of the online commerce in China. For some businesses, it can represent a big chunk of their overall business presence. This depends on their strategy or how they want to test the Chinese market.

10-What type of consumers are using cross-border platforms?

Chinese customers will go on cross-border platforms to look for high fashion goods and luxury goods because they trust the source. Cosmetics is a huge hit on cross borders as well.

Food products such as baby food, milk products and alcohol are popular too, because people trust the producers from overseas.

However, if you are selling a mass-market product, like, cookies or bathroom products, it is not recommended to use cross border models because the penetration is still very small compared to the whole e-commerce world in China.

You have to keep in mind that a larger proportion of cross border buyers are coming from top-tier cities.

So, if you want to target the middle class in China, then cross border is not going to be that effective.

The reason the cross-border trend is very popular today, is that it is good forcash flow, as you don’t pay duties immediately. You pay your duties and VAT only when you import the goods from bonded warehouses to mainland China. Then again, if you are talking about food with a limited shelf life, you might want to consider general trade.

Regarding the point of trust, technology is successfully solving the issue with the latest block chain and QR code tracking systems. Today in most supermarkets Chinese consumers can see the information of the producer, facilities, origins and business licenses. Some products may include sanitary tests etc. by scanning a QR code. And today, with all the recent food scandals, people in China want to have assurance of quality. Standards that need to be respected to penetrate the Chinese market are becoming tougher in order to better protect the Chinese consumers and ensure quality of goods.

11-Is it necessary to import to China? Can I sell directly to a cross border platform?

Yes, but now you need to have a Chinese legal entity that represents you on cross border platforms and takes responsibility. So, you have to make sure you choose wisely who will be your partner.

So, it’s becoming quite impossible just to be in your warehouse abroad and still sell to China, especially if you are doing classic operations like Tmall, JD, Taobao and so on.

Import to China: Cross border sales and the taxes

Basically, after you did your import to China, if your stock is in the bonded warehouse (Free Trade Zone), your goods are technically outside China. So if you don’t sell the products and don’t need to physically import them, your stock remains in that special area.

As soon as you make first sale, you have to make custom clearance and pay VAT.

On the other hand, if you choose to operate as a general trader, you must clear your goods and pay 100% of your duties and VAT as soon as your goods arrive in China. And then you can start selling.

This will have an impact afterwards on your logistics, especially on the delivery. The time lags between the customer order and the product reception will be longer under cross-border.

In general, it’s not difficult to import to China most of the products, but it takes an in-depth research, various testings and experiments as well as an adoptable strategy to be successful in China. Not to forget, that the country is now trying to improve its own high quality production and increase the level of trustability in local brands. So prepare for competition, changing of trends, and sizeable investment in the market. But if and when your brand takes off, it might just rocket up!